| |

Perpetuating the Horatio Alger MythFortune 500 CEOs, Elite Education, and the

|

|||||||||||||

|

| Horatio Alger on his graduation day from Harvard |

This "no need for a fancy degree" argument and maybe "no need for college at all" argument fits right into the Horatio Alger myth, and it is completely misleading, as this document demonstrates. As for Alger himself — the exemplar of this line of media hype — he was born in 1832 to a patrician Massachusetts family. In the late 1800s and early 1900s, after he had graduated from Harvard (as had his father), and after he had been dismissed from his job as a Unitarian minister for inappropriate sexual acts with boys in the congregation, he wrote a series of immensely popular books about poor kids who worked hard, caught a break, and became rich. His more than 100 books sold a stunning 20 million copies, and soon were a key part of the story America likes to tell about itself.

There is even a Horatio Alger Association of Distinguished Americans, formed in 1947, whose mission, as it says on its website, "is dedicated to the principles of integrity, hard work, perseverance, and compassion for others" and "to educate all youth about the limitless possibilities that are available through the American free enterprise system." Among the hundreds who have received the annual Horatio Alger Awards over the years are (just to draw from the letter A): baseball great Hank Aaron; Roger Ailes, the former chairman and CEO of Fox News; and Gene Autry, "America's Singing Cowboy."

|

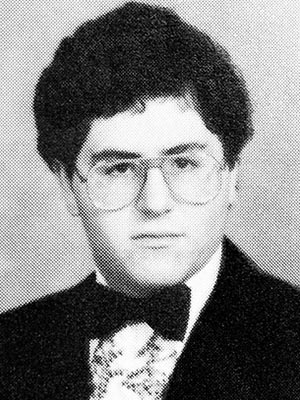

| Clarence Thomas receives an award from the Horatio Alger Association of Distinguished Americans in 2010 |

Further down in the alphabet is Supreme Court Justice Clarence Thomas, inducted into the Horatio Alger Association a few months after he was named to the Supreme Court. As the New York Times reported in July 2023, "His friendships forged through Horatio Alger have brought him proximity to a lifestyle of unimaginable material privilege. Over the years, his Horatio Alger friends have welcomed him at their vacation retreats, arranged V.I.P. access to sporting events and invited him to their lavish parties." (Another recipient in the T's: Donald Trump's father Fred.)

I, too, have studied the educational backgrounds of CEOs, with particular interest in how the educational trajectories of white male CEOs have differed from those of white women, African American, Latino and Asian CEOs. For me it has not been a "peculiar hobby" but part of a decades-long research program that resulted in multiple editions of three books and many articles. I, too, have found that most CEOs have not gone to Ivy League schools, and I, too, have found that a few did not earn college degrees. However, the data I have gathered and my reading of the data that Kang has gathered lead me to draw the opposite conclusion — it is a distinct advantage to have a degree from an elite school, and to attend an elite college even if you decide to leave before you earn a degree.

A closer look at the data

In one study, I looked at all of the white women, African Americans, Latinos, and Asian Americans who had become CEOs of Fortune 500 companies as of January 1, 2015 (n=249 at that time), and a matched "control" group of white men who had been CEOs of companies ranked similarly on the Fortune 500 list. I also used a data set that included all of the 4,512 men and women who were directors of the Fortune 500 companies in 2011. I not only looked to see where they had earned undergraduate and graduate degrees, but I coded the schools for elite status. To do so, I drew on the lists published annually by the U. S. News and World Report of top-ranked undergraduate colleges and universities, law schools, and MBA programs. This means that I not only saw (like Kang) if they earned undergraduate degrees or MBAs from Harvard or other Ivy League schools, but degrees from any of the 25 most prestigious undergraduate universities and the 25 most prestigious colleges (this list, therefore, includes elite universities like Stanford and MIT, and elite colleges like Williams, Amherst, and Swarthmore).

I found, among other things, that 9.8% of the CEOs and 14.1% of the Fortune 500 directors had degrees from Harvard. Depending upon the exact minute percent of American adults with a Harvard degree, that's an over-representation of at least 200 to 400%, which is about as strong as it gets when over-representation is used as a power indicator. I also found that fully 28% of the CEOs and 32% of the directors had undergraduate degrees from at least one of the elite schools. About 29% of the CEOs and 36% of the directors had earned MBAs, and the majority of these were from elite programs. About 10% of the CEOs and about 14% of the directors had law degrees, half of whom had attended elite programs. (There were notable, and statistically significant, differences when I compared the data for white men and the other groups — these differences, which are not particularly relevant to the argument of this article, and a more detailed description of the methods employed, can be found at the following link: http://whorulesamerica.net/power/elite_education.html).

It did not require my decades of research, or familiarity with my findings, to see the flaws in Kang's treatment of his own data. More than a few of the hundreds of people who responded to the online version of the Fortune article pointed out that a very small percentage of Americans attend Ivy League schools, and that Ivy League schools represent a small percentage of all the colleges in America. Therefore, they explained, the fact that Kang had found that 11.8% of the Fortune 100 CEOs in 2023 had attended Ivy League schools showed not that going to an Ivy League school didn't matter but, rather, how important an elite education could be. As one respondent put it, "Yes, the percentage is 11.8%, but that is many times more than the graduates from an Ivy league school. This professor skipped math class." And, as another noted, "2023 Fortune 100 CEOs, only 11.8% attended an Ivy as undergrads. There are 8 Ivy League schools - 10 if you add Stanford and MIT. There are around 2600 four-year colleges and universities in the US. So the Ivies make up 0.38% of all of the colleges and universities, yet make up 11.8% of the Fortune 100 CEO's."

Kang emphasizes that some of the 2023 Fortune 500 CEOs did not earn college degrees. As he inelegantly put it, "the largest place they had gone to was no college at all." Fortune went on to (sort of) explain: "Of the 500 CEOs on the list, seven or eight had no undergraduate degree, more than the combined degrees from any other college in the pool." Neither Kang nor Fortune draws the obvious conclusion that this, of course, means that 492 or 493 of the Fortune 500 did graduate from college (that is, 98.4% or 98.6% had undergraduate degrees). Whether intended or not, Kang's wording and Fortune's take on his findings both feed into the false assumption — increasingly prevalent these days — that it is not a sound financial investment to go to college (especially if it means going into debt). After all, if the "largest place they had gone to" was not to go to college, then obviously one can become a Fortune 500 CEO without college. (However, for the hundreds of millions of people who don't become CEOs, the gap between the lifetime salaries of those with and without a college degree has grown in leaps and bounds in the past 40 years. By 2021, the median pay gap between people with at least a B.A. and those with no college degree was over $20,000 a year for those between the ages of 22 and 27. The projections over 40 years show that the return on investment in college, across all degrees and majors, was almost $800,000 for low-income students, and $822,000 for all students [Hanson, 2022].)

Some further context and math are in order. I compared my 2011 and 2015 data with data previously gathered on the educational backgrounds of senior managers in American corporations. Writing in the mid-1980s, Useem and Karabel (1986) found that 16.8% had not earned college degrees. Thirty years earlier, C. Wright Mills (1956) had found that only 60% of the senior executives in the top corporations were college graduates, so 40% were not college graduates. In my two samples, 95.1% of the CEOs and 98.4% of the corporate directors had college degrees, numbers that are very similar to those Kang found. As this dramatic increase in the percentage of those with college degrees shows, since World War II the percentage of those without degrees declined from 40% to under 5%. My conclusion was that when it came to corporate leadership having a college degree had become "just about universal."

|

| Michael Dell's senior photo |

Moreover, some of the few in my sample of CEOs who had not earned college degrees were not exactly working-class heroes who rose to the top as the result of sheer hard work and a bit of luck, like the fictional Horatio Alger heroes. Michael Dell, the founder of Dell Computer, grew up with an orthodontist father and a stockbroker mother, attended one of the best high schools in Houston, and started as a pre-med student at the University of Texas before he dropped out to focus on his emerging computer business. Bill Gates, who attended a tony prep school in Seattle, dropped out of Harvard not once but twice to start what became Microsoft. Although the names of the "seven or eight" "no-college CEOs on Kang's list are not provided, Michael Dell is still the CEO of Dell, so he is very likely a prime example of a no-college CEO — a designation that ignores his upper-middle class upbringing, his excellent high school education, and his one year as a pre-medical student at the University of Texas flagship campus in Austin, which he left because the successful business he had founded during that year in college was riding the wave of rapid transition to computers.

|

| Mark Zuckerberg |

Still another example is Facebook founder Mark Zuckerberg, whose father was a dentist and whose mother was a psychiatrist. He graduated from Philips Exeter, one of the oldest and best-known prep schools in the country, before attending Harvard, where he started Facebook.

One more thing about Kang's findings. He is quoted in the article as claiming that it is an "extraordinary testament to the vitality of this country, the incredible range of universities that these people went to." Among the examples he gives are Doug McMillon, the CEO of Walmart, who went to the University of Arkansas, and Satya Nadella, the CEO of Microsoft, whose undergraduate degree is from India's Manipal Institute of Technology.

The Manipal Institute of Technology is ranked as one of the better engineering colleges in India, though I am not sure if it would be considered elite. I am sure, however, that the India Institute of Technology (IIT) is considered elite. It is often compared with MIT and Cal Tech. By now there have been 24 Fortune 500 CEOs who were born in India. Some have been undergraduates at schools in America (including Columbia, Berkeley, and Michigan), others have attended elite schools in other countries (such as McGill in Canada), but I have been struck by the fact that nine of the 24 (37.5%) attended IIT. Some of the "other" non-Ivy League schools that the CEOs in Kang's sample have attended, especially those who were educated outside the United States, may also have been elite.

Kang's narrow focus on the college CEO's attended, important though that is, completely overlooks class, race, ethnicity, and gender. Over the years, the research I have done on CEOs shows that with the exception of African Americans the overwhelming majority were born into upper middle and upper class families, those in the top 15% of the class system. This is true for the large majority who were born in America, but also those born elsewhere, like India or Latin America. Consideration of class background, of course, helps explain how college dropouts like Michael Dell, William Gates, and Mark Zuckerberg were able to succeed as they have.

As the examples of Dell, Gates and Zuckerberg make clear, a more complete examination of the role of elite education in the lives of future CEOs should also include attendance at elite boarding schools like Exeter, Andover, Choate, Groton, and many others (in America and abroad), even though college degrees and post-graduate work are important in understanding the educational trajectories of future Fortune 500 CEOs. This need for more complete information on class background and preparatory education sometimes poses research challenges because corporate executives, like politicians, are hesitant to reveal that they have attended elite secondary schools. More generally, they, too, are prone to perpetuate the myth that they pulled themselves up by their own bootstraps. But such research is essential if the power of American mythology is going to be fully assessed (see Zweigenhaft and Domhoff, 2018, for the full sweep of this literature over a 40-year period by a wide range of social scientists and historians).

The obituaries of corporate chieftains

I have learned, over time, to read the obituaries of those who run America's largest corporations with a grain of salt, and sometimes, more than a grain. They, too, can perpetuate the Horatio Alger myth and they too, can serve the corporate interests of the local business communities where the obituaries are published. Here are three examples, two that show the Horatio Alger myth at play, and one that shows the economic interests of a local community.

Laurence Tisch

The day after Laurence Tisch died, The New York Times (Kandell, 2003) announced his death with a front-page note stating: "Laurence A. Tisch, Self-Made Billionaire, Dies." Inside, in the first section of the paper, the full-page obituary began, "Laurence A. Tisch, the self-made New York billionaire who was hailed as a white knight for saving CBS Inc. from a hostile takeover and then reviled for gutting what was once the nation's premier broadcasting network, died early yesterday at Tisch Hospital of the New York University Medical Center."

Ten paragraphs into the obituary, the writer noted that Tisch's parents, who owned a factory, had given him an entrepreneurial boost when he was 23: "In 1946, Mr. Tisch's parents entrusted him with $125,000 to invest." This small head start from his parents — the equivalent of almost two million dollars in 2023 (more specifically $1,949,532) — didn't seem to undermine the obituary writer's opening claim that Tisch was a "self-made billionaire." Presumably he meant that Tisch started out "only" as a millionaire but was able to parlay that million into a billion.

Roberto Goizueta

When Roberto Goizueta, the Cuban-born CEO of Coca-Cola from 1980-1997, died in 1997, the media coverage was extensive, for he had risen to a higher position in the ranks of a major Fortune 500 corporation than any other Latino. The stories and obituaries written about him were quick to emphasize that he left Cuba a year and a half after Castro took power with, as the Associated Press put it, "little more than a suitcase." The Associated Press (10/18/97) informed its readers that he had only $20 in his pocket, though The New York Times (10/19/97) claimed he had $40. In either case, it seems that his life was a true Horatio Alger story.

But there's more to Roberto Goizueta's story. He actually came to America with much more than $20 or $40 in his pocket, and it is certainly misleading to claim that he "left Cuba with little more than a suitcase." Born in 1931, he was the only son of an architect and a sugar heiress. After he graduated from a Jesuit school in Havana, he spent a year at the Cheshire Academy, a New Haven prep school, before attending Yale, from which he graduated in 1953 with a degree in chemical engineering. Upon graduation, he decided against joining his father's architecture and construction business and instead went to work for Coca-Cola.

Therefore, when Goizueta came (back) to America at the age of 29, he may have had $20 (or maybe $40) in his pocket, but he also owned 100 shares of Coca-Cola stock, he had the finest education American or Cuban money could buy, and he had seven years' work experience as an executive with Coca-Cola. He may have come with only a fraction of the immense wealth into which he was born, but he had a good bit of what sociologists have come to call "social capital": networks of former friends and classmates who were themselves on the way to assuming positions of power in corporate America, as well as "cultural capital": the ability to move comfortably among people of wealth and education.

Alexander W. Spears, III

Alexander W. Spears III was the chief executive officer of Lorillard Tobacco Company. When he died in late January, 2001, both the New York Times and his hometown newspaper, the Greensboro News & Record, ran lengthy obituaries. These two obituaries could not have been more different.

Presumably the obituaries written about Robert E. Lee and Ulysses S. Grant differed in newspapers published north and south of the Mason Dixon Line. So, too, did these two obituaries, appearing in different newspapers in different parts of the country, and with different political and economic perspectives, present dramatically different portrayals of the deceased.

The News & Record obituary (Rutland, 2001) approached hagiography. The opening paragraph referred to Spears as "a tireless advocate for social justice," and went on to say of him such things as that he was "a high energy leader who always found time for civic involvement," and that he was "a tall stately man with a firm handshake and a warm style."

As the CEO of a tobacco company that was quite important to the economy of Greensboro, North Carolina, Spears had been a defender of the tobacco industry, and these efforts were phrased in laudatory terms. He "weathered attacks" and he "attacked back." About halfway through the lengthy obituary, most of which focused on his local civic involvements, the writer included the following: "During his tenure Spears weathered attacks on the industry from anti-smoking groups. He also participated in one of the tobacco industry's most infamous moments: testifying before Congress about nicotine and addiction. In 1994, the chief executives of the country's seven largest tobacco companies spoke before the House Subcommittee on health and Environment. The executives repeatedly denied that cigarette smoking is addictive and that they manipulate nicotine levels to hook smokers. During the hearings, Spears, then CEO of Lorillard, called the hearing 'a witch hunt' on the part of several of these Congressmen to gain support for their own legislation.'"

The New York Times obituary (Kaufman and Schwartz, 2001) gave Spears' congressional testimony much more prominence. It began its obituary in the following way: "Alexander Spears III, who joined other top tobacco executives in testifying before Congress in 1994 that they did not believe nicotine was addictive or caused disease, died Monday of lung cancer."

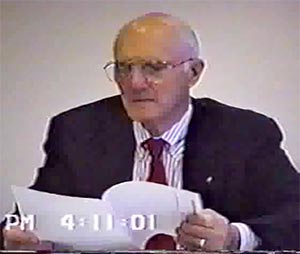

|

| Alexander W. Spears, III |

Nor did the Times obituary allow Spears the posthumous benefit of diffusion of responsibility by allowing his testimony to be embedded in a reference to the group of seven tobacco executives. The Times writer noted that Spears, in particular, provided an "unapologetic defense of his industry and its products." Spears' testimony that tobacco companies did not manipulate nicotine in cigarettes was especially important because he was a chemist and because this was a key issue as the Food and Drug Administration (F.D.A.) attempted to regulate tobacco. Moreover, the obituary made clear, the commissioner of the F. D. A. "grilled" Spears about the striking contradiction between Spears' testimony in 1994 and what he had written in a report 15 years earlier: "Although Mr. Spears testified to Congress that tar and nicotine could be found in similar levels in cigarettes, the F. D. A. challenged him with a 1981 Lorillard report written by Mr. Spears himself." In that report, Spears had admitted that the company's research was designed to increase nicotine levels over time.

The image one gets of Alexander Spears is dramatically different in these two obituaries. In his hometown newspaper, he appears to be an affable and engaging man with a powerful social conscience. In the New York Times, he is portrayed as an untrustworthy corporate leader who provided false testimony, a chemist who denied that cigarettes cause illness in humans. The latter claim is especially striking, since Spears' father (a doctor and a smoker) died of lung cancer, and Spears himself, also a smoker from the age of 18, had given up smoking after he suffered a heart attack in 1977, and died of lung cancer at age 71. The local paper made no attempt to turn Spears into a Horatio Alger figure — after all, his father was a doctor — but it did make every effort to emphasize his local philanthropy rather than the important role he played in denying the dangers of smoking. Today Spears is mostly remembered in his former hometown because a local branch of the YMCA is named after him.

Conclusion

The July 2023 Fortune article, with its emphasis on "no-college" CEOs and the variety of schools from which CEOs graduate, is a prime example of a larger pattern in which the corporate media encourages readers to believe that the American Dream is alive and well, that anyone can make it to the top, and that we can be proud of "the vitality of this country" and its free enterprise system. Some CEOs do in fact rise to the top from modest circumstances, but it is much less frequent than this article suggests, and increasingly it has become quite unlikely to happen if one does not have an undergraduate degree. In an online world, the Horatio Alger myth, now rebooted to appeal to those without college degrees, can be spread even more rapidly and widely than it was in the past.

References

Fortune Magazine (2023, June 14). A professor has tracked the colleges of Fortune 500 CEOs for 20 years. He was stunned to learn Ivy Leagues don’t matter that much. https://fortune.com/2023/06/14/

Hansen, Sarah (2022). The Payoff for a College Degree Is Smaller if You're a Low-Income Student, Money, January 25. https://money.com/college-roi-low-income-students-report/

Kandell, Jonathan (2003). Laurence A. Tisch, Investor Known for Saving CBS Inc. From Takeover, Dies at 80, New York Times, November 16, Section 1,

Kaufman, Leslie and John Schwartz (2001), Alexander Spears III, 68, A Tobacco Chief and Defender, New York Times, January 31.

Manduca, Robert, (2021), " The American Dream is less of a reality today in the United States, compared to other peer nations, Working paper, Washington Center for Equitable Growth, April 28, 2021.

Mills, C. Wright (1956). The Power Elite. New York: Oxford University Press.

Rutland, Aulica (2001). Spears Eulogized as Caring Civic Leader, News & Record,

Useem, Michael and Jerome Karabel (1986). Pathways to Top Corporate Management, American Sociological Review, 51, 184-200.

VanSickle, Abbie and Steve Eder (2023). Where Clarence Thomas Entered an Elite Circle and Opened a Door to the Court, New York Times, July 9. https://www.nytimes.com/

Zweigenhaft, Richard L. and G. William Domhoff (2018). Diversity in the Power Elite: Ironies and Unfulfilled Promises, Third Edition. Lanham, MD: Rowman & Littlefield.

This document's URL: http://whorulesamerica.net/diversity/horatio_alger_myth.html

mobile/printable version of this page

mobile/printable version of this page